Home prices across Canada expected to fall through the summer and beyond

Many would-be homebuyers across the country have been watching out for a dip in Canada's priciest real estate markets over the past few months, looking to get a bit of a lucky break amid the economic fallout of the pandemic.

Experts have had put forth different predictions for how the health crisis will affect the industry long-term, with some forecasts saying little will change in hot markets like Toronto and Vancouver, and others purporting that sales prices and volumes will drop — and stay unusually low for years to come as economies (and consumers) try to recover.

Now, a new national housing market outlook for this summer has been released by the Canada Mortgage and Housing Corporation (CMHC), and the projections vary greatly from city to city.

We took a deeper dive into the #housingmarket to see how recent economic disruption could impact 🇨🇦’s 6 largest urban centres. Check out the full report to learn more: https://t.co/cT7loQAXMg pic.twitter.com/1VtrGAGxYh

— CMHC (@CMHC_ca) June 23, 2020

On the West Coast, things have slowed slightly, with housing sales dropping from summer 2020 into early 2021, new builds doing the same, and even prices going down — but nothing too dramatic or sudden.

This is, the CMHC says, due to financial precarity across the board: "Weaker household budgets and the uncertain nature of the economic reopening. In addition, the uneven impact on buyers at different levels of income," the report reads.

The number of real estate transactions will rise again steadily from early 2021 to 2022 at a quicker pace than prices, according to CMHC, though it will not reach the peak of late 2019 by the end of 2022.

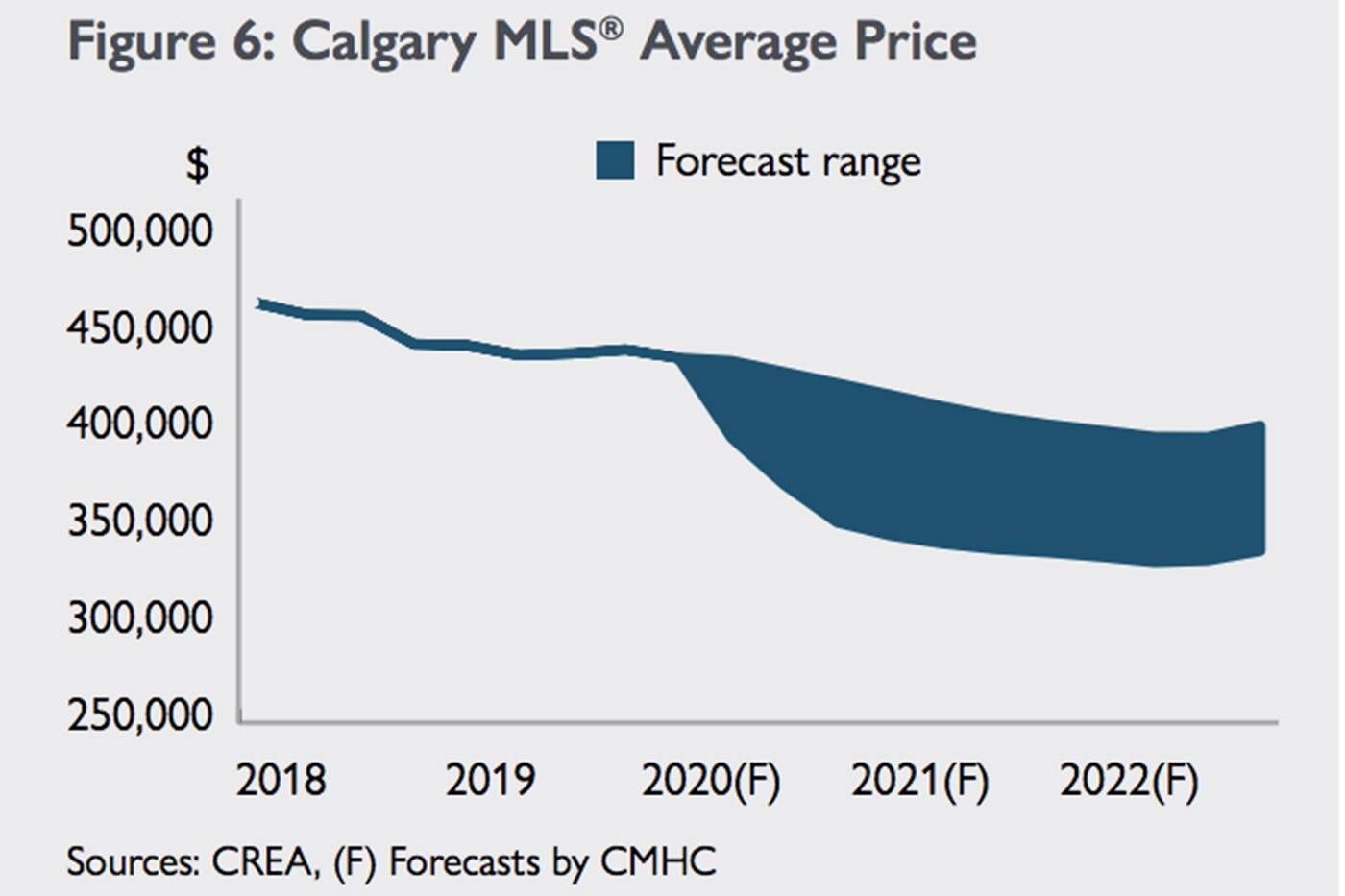

In Calgary, the construction of new homes this season will be more heavily impacted and brought to "a significantly slower pace" of as much as 64 per cent less than what it was prior to COVID-19, in part due to slower population growth and migration to the region, the Crown corporation believes.

In Calgary, the construction of new homes this season will be more heavily impacted and brought to "a significantly slower pace" of as much as 64 per cent less than what it was prior to COVID-19, in part due to slower population growth and migration to the region, the Crown corporation believes.

Sales of existing homes will also tumble, though far more slightly, around 13 to 27 per cent this year "as households adjust to a period of uncertainty."

But, as in many markets, "sales activity should gradually recover in 2021 and 2022 as employment conditions improve."

Prices are a bit harder to predict, it seems, and will likely be slightly down from the same time last year.

In Edmonton, predictions are largely the same (though on a lower amount scale due to an already cheaper market), with the recent hit to the oil market also being a huge factor.

Meanwhile, Toronto's tight market is expected to recover faster than others, with the number of sales actually nearing pre-coronavirus numbers in the second half of 2022, with a pattern of strong pre-construction sales continuing despite the current landscape.

Meanwhile, Toronto's tight market is expected to recover faster than others, with the number of sales actually nearing pre-coronavirus numbers in the second half of 2022, with a pattern of strong pre-construction sales continuing despite the current landscape.

But, the sheer amount of new builds could also mean a softer market in 2021 as far as prices are concerned.

"Toronto’s recovery will be slightly stronger than that of the rest of Ontario in 2021 and 2022," the document notes, adding that prices may continue to fall slightly this year, but will recover by early 2021 and continue to increase over the course of the year. Because of the ability for those in many industries in the city to work from home, there appears to be less buyer caution and financial worry.

"Short-term job losses will occur primarily in the retail and hospitality industries, which typically employ lower paid workers. Based on their average income level, these groups are more likely to rent than own," the CMHC says. "Therefore, the negative impact to the homeownership market will likely be less severe."

Buyers will be slightly more uncertain in Ottawa, with all housing stats in general "expected to trend lower over the remainder of 2020" and both the volume and price of sales due to stay pretty "muted" until 2022.

And finally, in Montreal, the short-term forecast shows a sharp drop in the number of sales in the middle of this year, then a shift to increase by the end of the year "as the economy recovers and employment gains strengthen," reaching record highs once again by 2022.

And finally, in Montreal, the short-term forecast shows a sharp drop in the number of sales in the middle of this year, then a shift to increase by the end of the year "as the economy recovers and employment gains strengthen," reaching record highs once again by 2022.

Despite a reduced demand for housing in the city amid everything that's going on, the report says that "prices are still expected to trend slightly higher by 2022 and could even exceed their pre-pandemic levels" despite what initially may look like a trend downwards this summer.

Some trends for all of the major markets that the CMHC touched on in its new report include the fact that vacancy rates for rental units will increase pretty much across the board, with an increased availability of apartments for potentially lower prices.

Some trends for all of the major markets that the CMHC touched on in its new report include the fact that vacancy rates for rental units will increase pretty much across the board, with an increased availability of apartments for potentially lower prices.

This is very good news, given that those on lower paying jobs have been disproportionately economically impacted by the pandemic, and that rents hit record highs in a number of Canadian cities last year.

Hector Vasquez

Latest Videos

Join the conversation Load comments